Introduction SIP Mutual Fund Australia: G’day Future Millionaires

Fair dinkum, mates! Living in Australia gives you some of the world’s best investment opportunities, but if your money’s sitting in a savings account earning minimal interest, you’re missing out significantly. With over 8 million Australians (Source: ASX Australian Investor Study 2023) already investing in shares and digital platforms making it easier than ever, there’s never been a better time to grow your wealth through SIP mutual fund Australia opportunities.

Welcome to SIP Investing in Australia – the straightforward way to build your financial future without needing to be a stock market expert. Whether you’re a tradie in Perth, a teacher in Adelaide, a tech worker in Melbourne, or a retiree on the Gold Coast – systematic investing is your path to financial independence.

And the most accessible part? You can start with just $100 per month. Let’s explore this incredible opportunity!

For our international readers, check out our global investment guides for more options.

What is SIP Investing? Understanding (SIP Mutual Fund Australia) the Aussie Approach

SIP (Systematic Investment Plan) – commonly known as “Auto-Investing” or “Regular Savings Plans” in Australia – represents your automated strategy for wealth accumulation. It’s not a specific financial product, but rather a disciplined methodology of investing fixed amounts at regular intervals, regardless of market conditions.

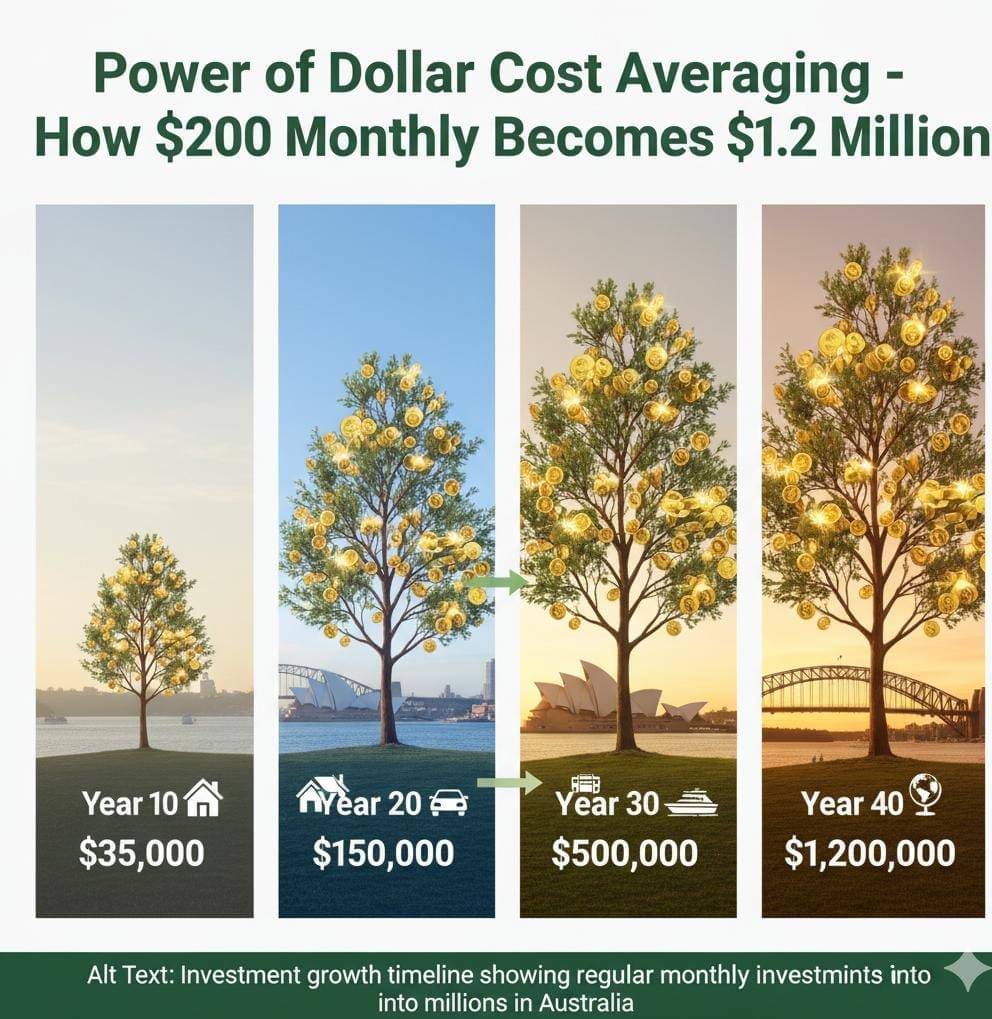

Real Australian Example: Think of purchasing sausages for your barbecue. When prices drop at Woolworths, you purchase in larger quantities. When prices increase, you buy only what you immediately need. Over time, your average cost stabilizes. This exemplifies Dollar Cost Averaging – the fundamental principle that makes SIP investing effective!

Calculate Your Investment Potential: Use the official ASIC MoneySmart Compound Calculator to visualize how $200 monthly investments could potentially grow to $1 million over 40 years!

Expand Your Knowledge: Explore our comprehensive guide on Understanding ETFs and Managed Funds for Australian Investors for deeper insights.

Why 2025 Presents Ideal Conditions for SIP Investing in Australia

The Australian Economic Outlook 2025

• GDP Growth Projections: Anticipated 2.5-3% growth for 2025, supported by robust resources and services sectors (Source: Reserve Bank of Australia Economic Outlook)

• Inflation Management: Expected stabilization around 2.5-3% under RBA monetary policy (Source: RBA Monetary Policy Statements)

• Market Resilience: ASX 200 demonstrating consistent performance with reliable dividend yields (Source: ASX Quarterly Reports)

The Digital Investment Revolution

• Growing Investor Base: Over 8 million Australians now participate in direct share investments (Source: ASX Australian Investor Study 2023)

• Automated Investment Features: Available across all major Australian investment platforms

• Accessible Investing: Fractional shares enabling broader access to blue-chip stocks

Current Market Performance Analysis: 2025 Data

Australian and International Fund Performance Metrics

• ASX 200 Index Funds: Historical average returns of 8-10% including dividend reinvestment (Source: Vanguard Australian Shares Index Fund Performance)

• Australian Equity Funds: Average returns of 9-12% incorporating franking credit benefits (Source: Morningstar Australian Equity Fund Analysis)

• Global ETFs: International diversification yielding 10-14% returns (Source: BlackRock Global ETF Performance Reports)

• Dividend-Focused Funds: Income-oriented returns of 6-8% with growth potential (Source: AMP Capital Dividend Strategy Funds)

Leading Investment Platforms in Australia 2025

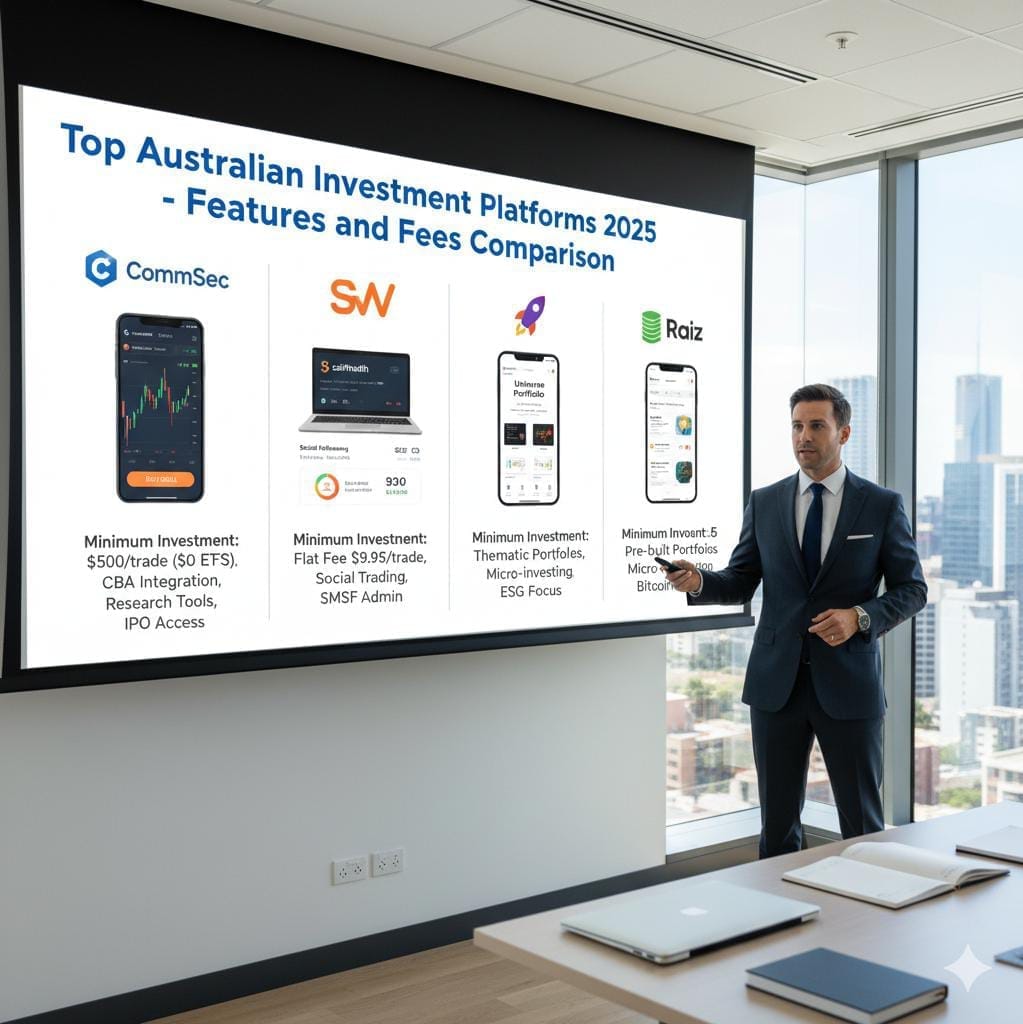

Recommended Platforms for New Investors:

• CommSec Pocket: Australia’s premier platform for beginners with educational resources

• SelfWealth: Popular flat-fee trading platform among younger investors

• Spaceship Voyager: Commission-free platform designed for new generation investors

• Raiz Invest: Micro-investing application featuring round-up investment capabilities

• Stake: Zero-commission ASX and US market trading access

Regulatory Reference: Australian Securities and Investments Commission (ASIC) – Investment Platform Guidelines

Detailed Platform Analysis: Comprehensive review of Best Investment Platforms in Australia 2025

ATO Regulations and Tax Benefits for 2025 Investors

Maximize your investment returns leveraging these Australian tax advantages:

• Franking Credits: Receive tax credits for corporate taxes already paid on dividends

• Capital Gains Discount: 50% capital gains tax reduction for investments held beyond 12 months

• Superannuation Benefits: Tax-advantaged retirement savings structures

• Negative Gearing: Tax deductions applicable to investment-related losses

Official Taxation Reference: Australian Taxation Office (ATO) – Investment Taxation Guide

Comprehensive SIP Investment Starting Guide 2025

Step 1: Determine Your Investment Account Structure

• Standard Brokerage Account: Suitable for general wealth accumulation

• Superannuation Investment Account: Tax-optimized retirement planning

• Education Savings Plan: Future-focused educational funding

Step 2: Platform Selection Criteria

Top Australian Platform Recommendations:

• CommSec Pocket: Optimal for beginners with comprehensive features

• SelfWealth: Ideal for cost-conscious investors preferring flat fees

• Spaceship Voyager: Excellent for younger investors starting with smaller amounts

• Raiz Invest: Perfect for developing micro-investment habits

• Stake: Superior for combined ASX and US market accessibility

Step 3: Initial Investment Selection (2025 Strategy)

Beginner-Friendly Recommendations: ASX 200 Index Fund or Diversified ETF

• Immediate diversification across Australia’s leading corporations

• Integrated professional management within index funds

• Demonstrated long-term performance based on ASX historical data

Suggested Initial Investments:

• Vanguard Australian Shares Index ETF (VAS) – Comprehensive Australian market exposure

• iShares Core S&P/ASX 200 ETF (IOZ) – Low-cost ASX 200 tracking

• Betashares Australia 200 ETF (A200) – Cost-effective market access

Step 4: Establish Automated Investment Schedule

• Initial Investment: Begin with $100 (minimum requirement on most platforms)

• Investment Frequency: Select fortnightly or monthly intervals

• Funding Method: Enable automatic transfers from your Australian bank account

Step 5: Maintain Consistent Investment Discipline

• Portfolio Review: Conduct annual assessments, avoid daily price monitoring

• Market Volatility: Continue automatic investments during market downturns

• Contribution Growth: Increase investment amounts with salary advancements

• Income Enhancement: Explore additional income streams through 7 simple methods to make money to amplify your SIP investment capacity

Complete Setup Tutorial: Detailed instructions on How to Establish Auto-Investing on Australian Platforms

Advanced 2025 Strategies for Australian Investors

1. The Pay Rise Bump Strategy

Increase your automatic investment by 50% of every pay rise. This painless approach dramatically accelerates wealth building.

2. Three-Pillar Aussie Portfolio

Diversify across ASX market sectors:

- 50% Australian Shares (With franking credit benefits)

- 30% International Shares (Global diversification)

- 20% Bonds and Cash (Stability and emergency funds)

3. Superannuation Boosting

- Salary Sacrifice: Extra contributions from pre-tax income

- Government Co-contributions: Free money for low-income earners

- Spouse Contributions: Tax benefits for contributing to partner’s super

Advanced strategies: Wealth Building Beyond Superannuation.

Common 2025 SIP Mistakes to Avoid in Australia (ASIC MoneySmart Warnings)

- Market Timing Attempts: Trying to outsmart the market instead of consistent investing

- Ignoring Franking Credits: Missing out on valuable tax refunds from Australian shares

- Overcomplicating Portfolio: Too many funds creating confusion and higher fees

- Emotional Trading: Buying during FOMO and selling during panic

- Neglecting Super: Not maximising Australia’s world-class retirement system

Frequently Asked Questions (2025 Aussie Edition)

Q: Can I really start with just $100?

A: Too right, mate! Most platforms allow $100 minimum, some even lower with micro-investing apps.

Q: Are these platforms safe and regulated?

A: Absolutely! All regulated by ASIC with strict investor protection rules.

Q: What about tax on my investments?

A: You’ll get an annual statement from your platform for your tax return – it’s pretty straightforward.

Q: Should I invest outside super or focus on super?

A: Both! Super for retirement (tax benefits) and regular investing for goals before retirement age.

More FAQs: Australian Investment Questions Answered.

Industry Growth Metrics 2025 Australia

- Share Investors: 8 million+ Australians directly own shares

- ETF Assets: $150+ billion in Australian ETFs

- Youth Participation: 45% of new investors under 35

- Digital Platform Growth: 25% annual increase in app-based investing

Your 7-Day Aussie Investment Launch Plan

Day 1: Calculate your goals using MoneySmart calculators

Day 2: Research and choose your investment platform

Day 3: Gather your TFN and bank details

Day 4: Open your account with myGov verification

Day 5: Set up first $100 automatic investment

Day 6: Schedule annual portfolio review

Day 7: Continue learning through Australian resources

Special Section: Young Australian Investors

For Students and Young Workers:

- Start with micro-investing apps like Raiz or Spaceship

- Consider first home super saver scheme

- Take advantage of compound interest over decades

- Balance investing with enjoying your 20s and 30s

Guide for young Aussies: Investing in Your 20s and 30s – Australian Edition.

Final Motivation: Build Your Australian Dream

As the legendary Aussie investor Peter Thornhill says: “The stock market is the only market where things go on sale and everyone gets too scared to buy.”

Your $100 automatic investment today is taking advantage of those sales. In the stable environment of the Australian economy, with its strong regulations, world-class companies, and unique tax advantages, your regular investments can grow into a proper nest egg.

The numbers don’t lie – 8 million+ Australians are already building wealth through share ownership. You’re joining a savvy bunch who understand that getting started beats waiting for the perfect time.

Don’t overthink it. Don’t put it off until “one day.” Your future self, enjoying financial freedom somewhere beautiful, will thank you for starting today.

Start your automatic investment journey. No worries!

Disclaimer: Investing involves risk, including possible loss of principal. Past performance does not guarantee future results. This content is for educational purposes only and does not constitute financial advice. Consider your personal circumstances and consult with a qualified financial advisor before making investment decisions.