SIP Investing Pakistan 2025: Complete Guide

Introduction: SIP Investing in Pakistan Revolution is Here!

Bhaiyo aur Behno! Pakistan mein investment ka zamana aa gaya hai! With over 200,000 new investors joining the stock market annually and mutual fund industry crossing Rs 2.5 trillion in assets, there’s never been a better time to start your SIP journey.

Official Source: SECP Pakistan Market Growth

Salam and welcome, future crorepatis! If you’re reading this, you’re already ahead of millions who keep saying “kal karunga.” Whether you’re a student in Lahore, a software engineer in Karachi, or a professional in Islamabad – this 2025 SIP Investing in Pakistan guide is your blueprint to halal wealth creation.

For our international readers, check out our global guide: SIP Investing for International Beginners

Why 2025 is the Perfect Year for SIP Investing in Pakistan?

The Economic Landscape is Improving

Pakistan’s economic indicators show promising signs:

- GDP Growth: Projected to reach 3-4% in 2025 with IMF program support

- Inflation Control: Expected to stabilize around 12-15% from current highs

- Market Recovery: KSE-100 showing strong recovery signals after recent corrections

Youth Investment Boom: Aap Akelay Nahi Hain! so lets start SIP Investing in Pakistan

The investment scene in Pakistan is transforming rapidly:

- Over 60% of new investors are under 35 years old

- Digital platforms making investing accessible from Peshawar to Karachi

- Islamic finance options growing rapidly for Sharia-compliant investors

What Exactly is SIP? Samjhein Bina Tension Liye!

SIP (Systematic Investment Plan) is your automated ticket to wealth creation. It’s not a product but a tarika – investing fixed amounts regularly in mutual funds.

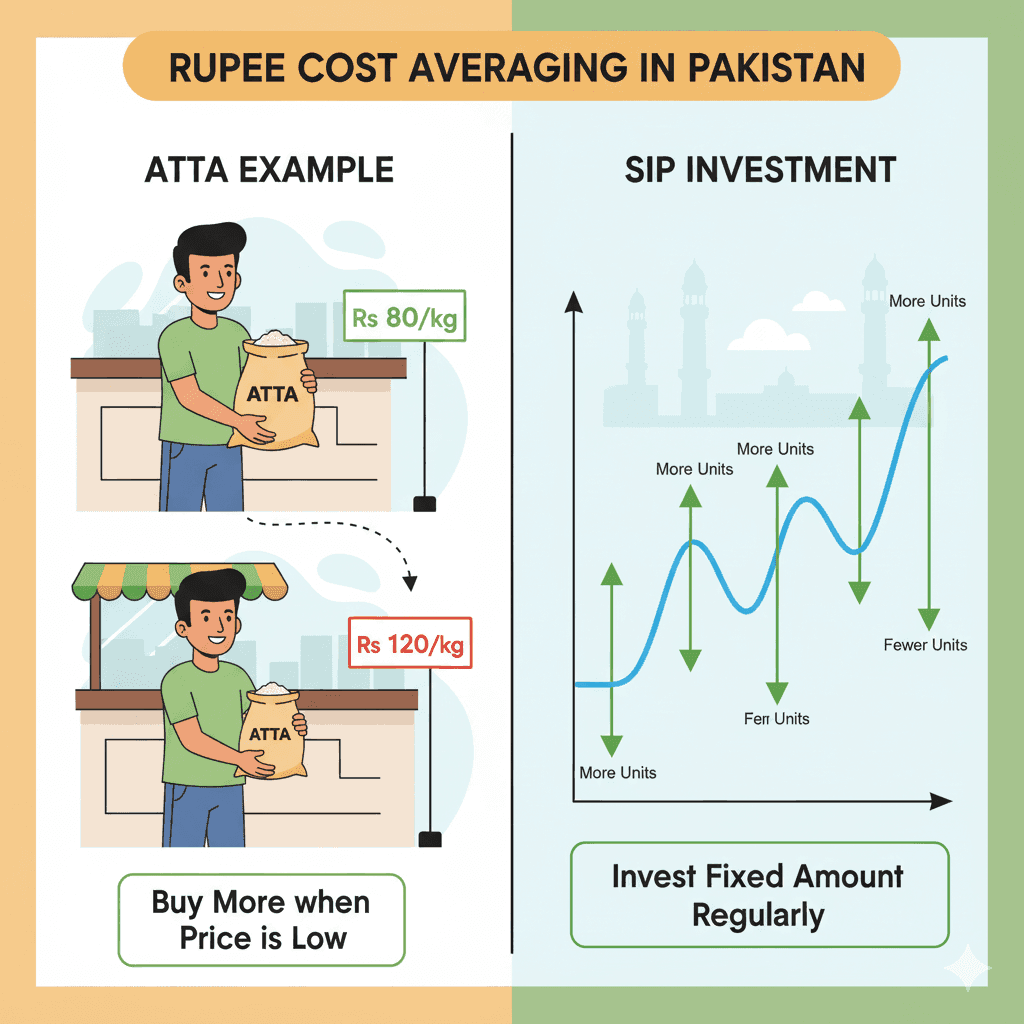

Real Pakistani Example: Think of buying atta during different seasons. When prices are low, you get more kilos for your money. When high, you get fewer kilos. Over years, your average cost becomes reasonable. That’s Rupee Cost Averaging – SIP ka superpower! so don’t be late and start SIP Investing in Pakistan.

Calculate Your Potential: Use our SIP Calculator Pakistan to see how Rs 5,000/month can become Rs 1 crore in 25 years! Through SIP Investing in Pakistan.

Learn more about online earning without investment: 7 Simple Methods to Make $500+ Monthly – No Money Needed to Start (2025 Edition)

Current Market Performance: 2025 Real Data

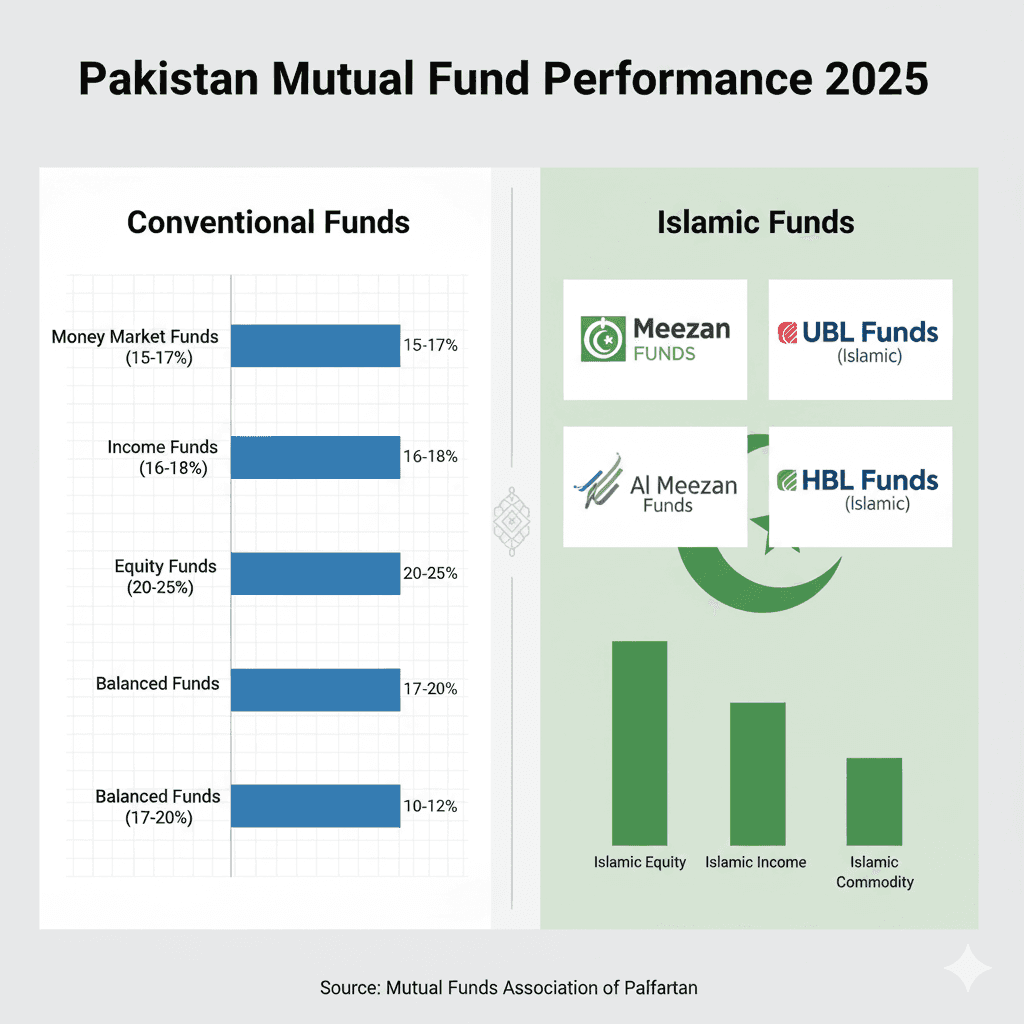

Conventional Fund Returns

- Money Market Funds: ~15-17% (annualized)

- Income Funds: ~16-18% (annualized)

- Equity Funds: ~20-25% (long-term average)

- Balanced Funds: ~17-20% (annualized)

Islamic Funds: Halal Investing Options

Islamic funds have shown impressive growth while maintaining Sharia compliance: which is also called SIP Investing in Pakistan.

Top Performing Islamic Funds:

- Meezan Islamic Fund: Consistent performer with Sharia compliance

- Al Meezan Mutual Fund: Diverse Islamic investment options

- UBL Funds: Multiple Sharia-compliant categories

- HBL Funds: Comprehensive Islamic fund offerings

Source: Mutual Funds Association of Pakistan

Detailed analysis: Best Islamic Funds in Pakistan 2025

Latest SECP Regulations for 2025 Investors

Stay updated with recent SECP changes affecting your investments:

- Enhanced transparency in fund management

- Stricter compliance requirements

- Improved investor protection mechanisms

- Digital onboarding facilities

Official Source: SECP Latest Regulations

Step-by-Step SIP Investing in Pakistan Starting Guide 2025

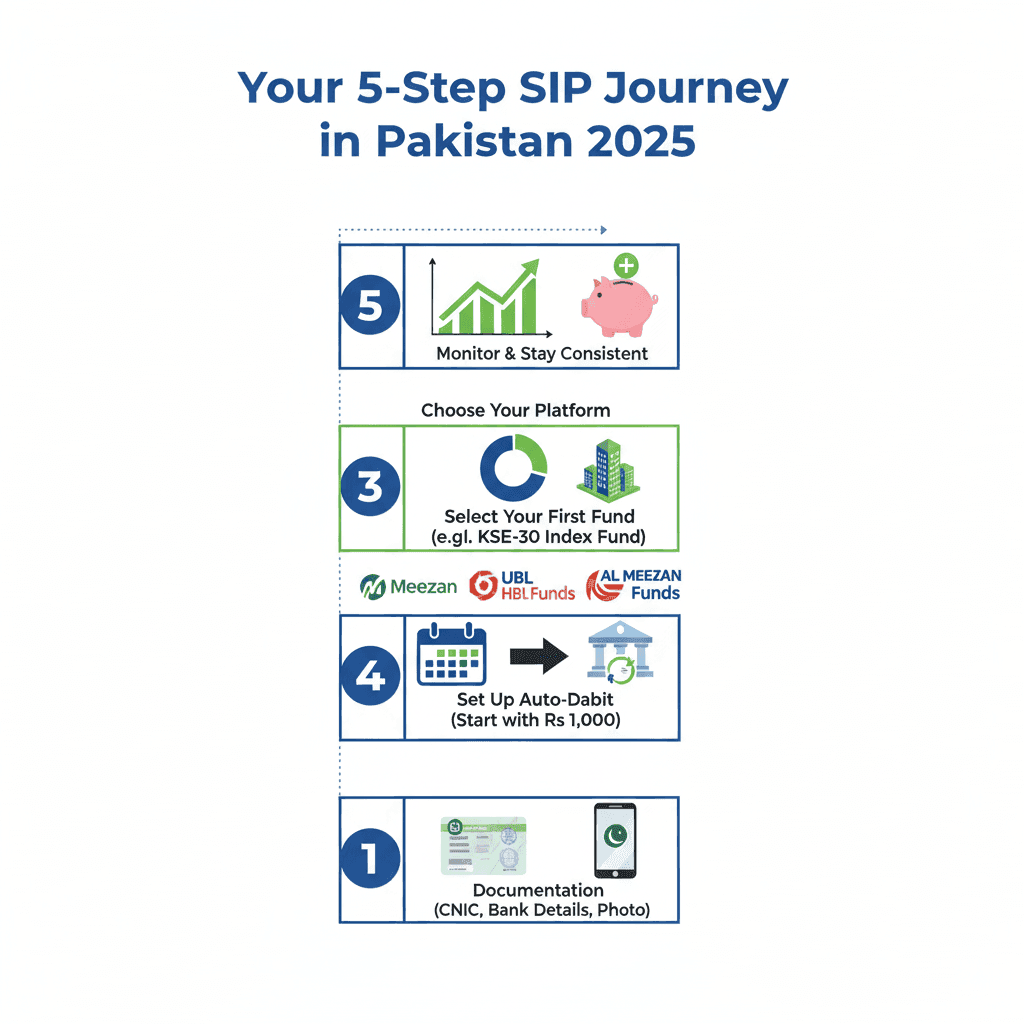

Step 1: Documentation Process (Online/Offline)

Documents needed:

- CNIC (Must)

- Bank Account Details

- Mobile Number

- Recent Photograph

Step 2: Choose Your Platform

Top Recommended Platforms:

- Meezan Funds: Leading Islamic investment platform

- UBL Funds: Comprehensive conventional and Islamic options

- HBL Funds: Extensive branch network nationwide

- Al Meezan: Pure Sharia-compliant investing

- MCB Funds: Strong conventional fund options

Step 3: Select Your First Fund (2025 Strategy)

Beginner’s Choice:

- KSE-30 Index Fund or Islamic Equity Fund

- Diversification in top companies

- Professional management

- Regular profit distributions

Recommended Starter Funds:

Step 4: Set Up Auto-Debit

- Start with Rs 1,000 (increase gradually)

- Choose convenient date each month

- Enable auto-debit from bank

Step 5: Monitor & Stay Consistent

- Review quarterly, not daily

- Never stop SIP during market falls

- Increase SIP amount with salary hikes

Complete tutorial: How to Open Mutual Fund Account in Pakistan

Advanced 2025 Strategies for Pakistani Investors

1. Step-up SIP: Wealth Accelerator

Increase your SIP by 10% annually. Example:

- Year 1: Rs 5,000/month

- Year 2: Rs 5,500/month

- Year 3: Rs 6,050/month

This can reduce your wealth creation timeline significantly!

2. Multi-Asset Allocation for Pakistani Market

Diversify across:

- 50% Equity Funds (Growth)

- 30% Income Funds (Stability)

- 20% Islamic Commodity Funds (Hedge)

3. Goal-Based SIP Planning

- Short-term (1-3 years): Money Market Funds

- Medium-term (3-7 years): Balanced Funds

- Long-term (7+ years): Equity Funds

Advanced strategies: Portfolio Diversification for Pakistani Investors

Common 2025 SIP Mistakes to Avoid in Pakistan

- Emotional Investing: Ghabrahat during market falls

- Over-diversifying: 2-3 good funds beat 10 average ones

- Ignoring Charges: Even small fees can cost lakhs over time

- Not Reviewing: Annual portfolio check necessary

- Following Crowd: Independent research is key

Frequently Asked Questions (2025 Pakistan Edition)

Q: Kya main sirf Rs 1,000 se shuru kar sakta hun?

A: Bilkul! Most funds allow Rs 1,000 minimum SIP. Start small, increase gradually.

Q: Islamic funds mein returns kaisay hain?

A: Alhamdulillah, Islamic funds have shown competitive returns with halal compliance.

Q: Itnay funds mein se kaise choose karoon?

A: Start with KSE-30 Index Fund. As you learn, add 1-2 more diversified funds.

Q: Agar market gir gaya to kya karoon?

A: Best time! You’ll buy more units at lower prices. This is SIP’s biggest advantage.

More FAQs: Pakistan Investment Questions Answered

Industry Growth Metrics 2025 Pakistan

- Mutual Fund AUM: Rs 2.5+ trillion

- New Investors: 200,000+ annually

- Digital Transactions: Growing rapidly

- Islamic Funds Share: Increasing significantly

Your 7-Day Action Plan

Day 1: Calculate your goals using SIP Calculator

Day 2: Gather CNIC, bank details

Day 3: Choose your investment platform

Day 4: Complete documentation process

Day 5: Start Rs 1,000 SIP in chosen fund

Day 6: Set reminders for monthly investments

Day 7: Educate yourself further (read one financial article)

Special Section: Overseas Pakistanis

Roshan Digital Account holders can easily invest in Pakistani mutual funds:

- Dollar-based investments available

- Easy repatriation of funds

- Tax benefits for overseas Pakistanis

- Full digital process

Guide for NRPs: Overseas Pakistani Investment Guide

Final Motivation: Join Pakistan’s Wealth Creation Story

Yaad rakhein, aaj ka faisla kal ki aapki financial freedom tay karega. Pakistan ki economy mein opportunities barh rahi hain, aur aapka chota sa Rs 1,000 SIP aapke bade sapno ki buniyad ban sakta hai.

Data dikhata hai ke young Pakistan invest kar raha hai. Digital platforms ki wajah se Peshawar se Karachi tak har koi ab invest kar sakta hai.

Sochte mat rahiye. Aaj shuru karein. Aapka future crorepati aap ka shukriya ada karega.

Start your SIP. Aaj. Abhi.

Disclaimer:

Mutual fund investments( SIP Investing in Pakistan)are subject to market risks. Please read all scheme-related documents carefully before SIP Investing in Pakistan. Past performance is not indicative of future returns. This content is for educational purposes only. Consult with a financial advisor before investing.