SIP Investing UAE 2025

Introduction: Welcome to the UAE Investment Revolution!

Marhaba, future millionaires! Living in the UAE gives you an incredible advantage – tax-free income and world-class investment opportunities. But if your money is sitting in a savings account earning 0.5%, you’re missing out on the real wealth-building potential of this dynamic economy.

Welcome to SIP Investing in the UAE (United Arab Emirates) . It’s the smart, automated way to grow your wealth. Enjoy the UAE’s tax benefits. It doesn’t matter if you’re a British engineer in Dubai. You could be an Indian teacher in Abu Dhabi. Alternatively, you might be a Filipino nurse in Sharjah. You could also be an Emirati professional building your future. Systematic investing is your golden ticket.

And the best part? You can start with just AED 500 per month. Yalla, let’s begin your wealth journey!

For our global readers, explore our international guides: SIP Investing for Global Citizens

For deeper insights into global News update , explore our comprehensive analysis: Trump’s Gaza Peace Plan – Historical Context & Future Implications

What is SIP Investing? The UAE Way

”Why SIP Investing UAE Works in 2025 ? ”

SIP (Systematic Investment Plan) . what we call “Auto-Investing” or “Regular Savings Plans” in the UAE – is your strategy to build wealth. You can set it and forget it. It’s not a product, but a powerful method of investing fixed amounts regularly, regardless of market conditions.

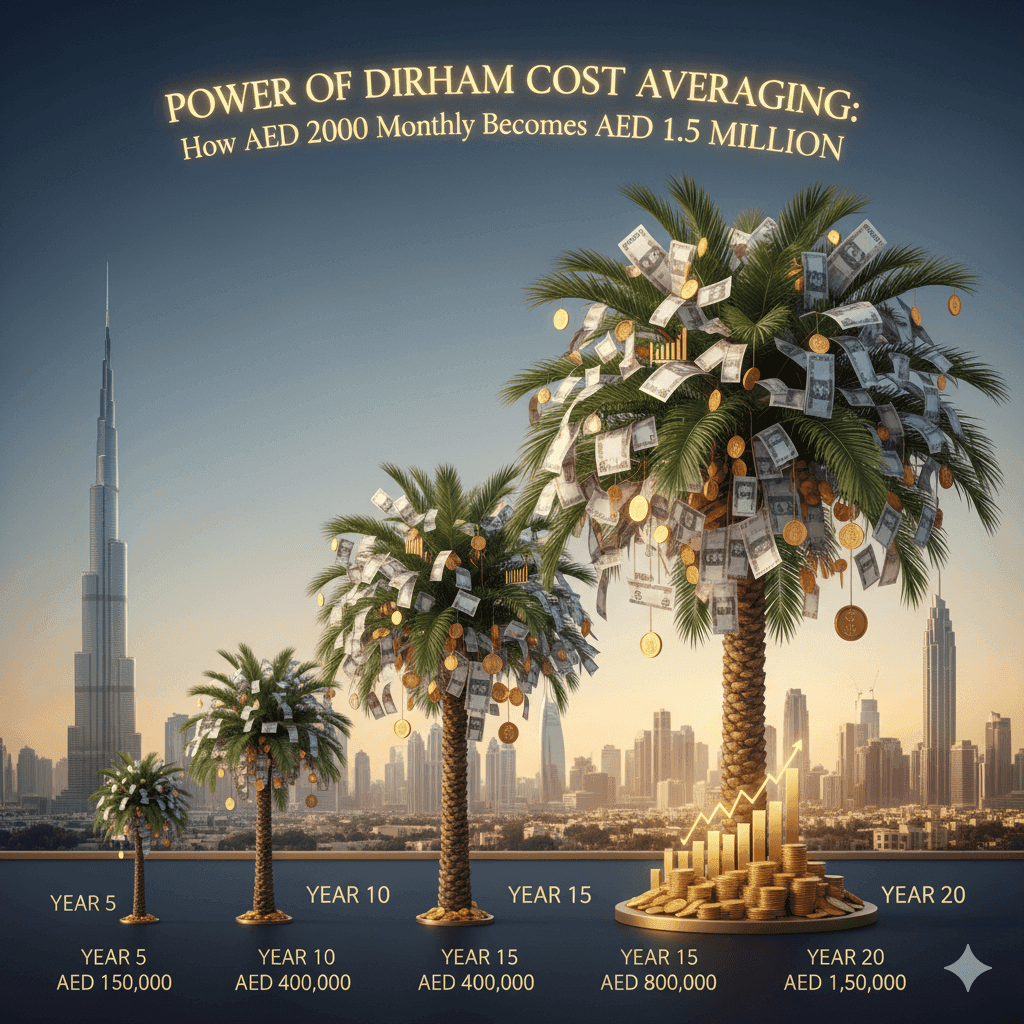

Perfect UAE Example: Think of filling up your car with petrol. When prices are low, you fill the tank. When prices are high, you put in just enough. Over time, your average cost balances out. That’s Dirham Cost Averaging – the engine that makes SIP work in the UAE!

Calculate Your Potential: Use the UAE Investment Calculator to see how AED 2,000/month can become AED 1 million in 20 years!

Why 2025 is Perfect for SIP Investing in the UAE

- GDP Growth: Projected 4-5% for 2025 driven by oil and diversification

- Inflation Control: Stable at 2-3% with strong currency peg

- Market Access: Gateway to global markets and emerging opportunities

The Digital Investment Boom is Here

- Over 500,000 UAE residents now invest through digital platforms (SCA Market Report)

- Auto-investing features available on all major UAE platforms

- Fractional investing makes global markets accessible to everyone

Current Market Performance: SIP Investing UAE 2025 Real Data

UAE and International Fund Returns

- UAE Equity Funds: ~8-12% (annual average)

- Global Index Funds: ~10-14% (long-term average)

- Emerging Markets Funds: ~12-18% (higher growth potential)

- Islamic Funds: ~7-10% (Sharia-compliant returns)

While building your investment portfolio, consider diversifying your income streams. Learn practical strategies in our guide – Click here to discover 7 simple methods to earn $500 monthly without investment! : 7 Simple Methods to Make Money in 2025

Top Performing Investment Platforms in UAE

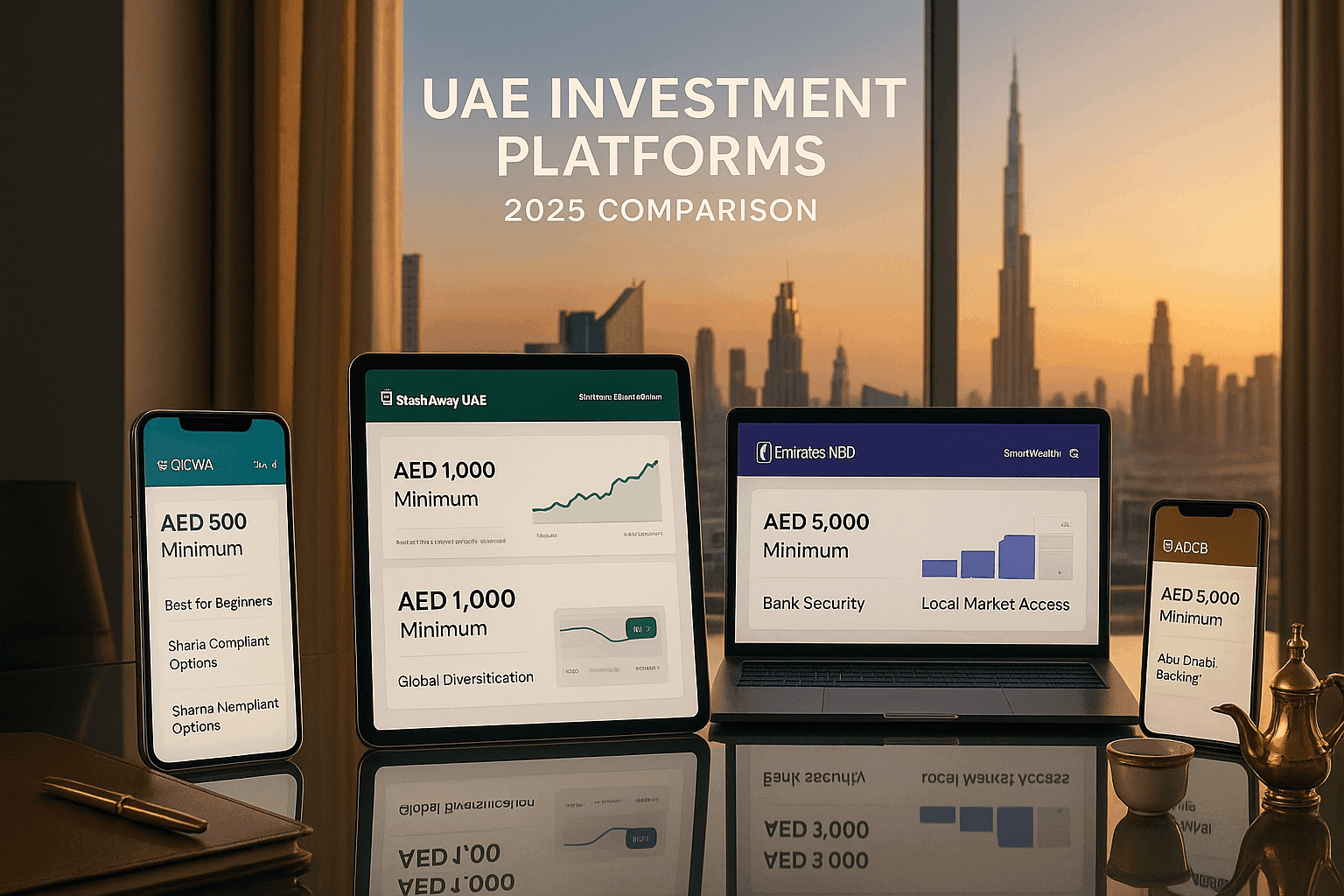

For Beginner Investors for SIP Investing in UAE:

- Sarwa Invest: Leading robo-advisor with low minimums

- StashAway UAE: Global portfolio management

- Emirates NBD Smart Wealth: Bank-backed investment platform

- ADCB Invest: Abu Dhabi’s premier investment service

- Mashreq Wealth: Comprehensive wealth management

Official Source: Securities and Commodities Authority UAE

Detailed analysis: Best Investment Platforms in UAE 2025

UAE Regulatory Environment and Tax Benefits for SIP Investing UAE

Maximize your returns with UAE’s unique advantages:

- Zero Income Tax: Keep 100% of your investment returns (UAE Ministry of Finance)

- No Capital Gains Tax: All your growth is tax-free

- Wealth Tax Free: No inheritance or wealth taxes in the UAE

- International Access: Invest in global markets from UAE hubs

Official Source: UAE Investor Protection Guide

Step-by-Step SIP Starting Guide 2025 for SIP Investing UAE

Step 1: Choose Your Investment Account Type

- Regular Investment Account: For general wealth building

- Savings Plan Account: Automated regular investments

- Education Savings Account: For children’s future education

Step 2: Select Your Platform

Top Recommended UAE Platforms for SIP Investing UAE 2025

- Sarwa Invest: Best for beginners and automated investing

- StashAway UAE: Excellent global diversification

- Emirates NBD SmartWealth: Perfect for bank customers

- ADCB Invest: Abu Dhabi’s trusted platform

- Mashreq Neo Invest: Digital-first approach

Step 3: Pick Your First Investments for (SIP Investing UAE 2025 Strategy)

Beginner’s Choice: Global Index Fund or Sharia-Compliant Portfolio

- Instant global diversification across multiple markets

- Professional portfolio management built into platforms

- Proven long-term returns with UAE market access

Recommended Starter Investments for SIP Investing UAE:

- Sarwa Core Portfolio: Automated global diversification

- StashAway General Investing: Risk-managed portfolios

- ENBD SmartWealth Funds: Bank-managed options

Step 4: Set Up Automatic Investments

- Start with AED 500 (most platforms allow this minimum)

- Choose monthly investment date (align with salary)

- Enable auto-debit from your UAE bank account

Step 5: Monitor and Stay Consistent

- Review quarterly, avoid daily checking

- Never stop during market volatility

- Increase contributions with salary growth

Investing success isn’t just about financial knowledge – it’s also about maintaining the right mindset. For insights on managing investment stress and emotional balance, read our guide: How to Deal with Depression and Maintain Mental Wellness

Advanced 2025 Strategies for UAE Investors

1. The AED Bump-Up Strategy

Increase your automatic investment by 5% every 6 months. This aligns with typical UAE salary growth patterns.

2. Multi-Currency Portfolio Approach

Diversify across (DIFC Multi-Currency Guide):

- 40% USD Denominated (Global equities)

- 30% AED Denominated (UAE and GCC markets)

- 20% EUR Denominated (European markets)

- 10% Emerging Markets (Higher growth potential)

3. Sharia-Compliant Investing

- Sarwa Halal Portfolio: Fully Sharia-compliant options

- StashAway Sharīʿah: Religious-compliant investing

- Local Islamic Banks: Traditional Islamic finance

Advanced strategies: Wealth Management for UAE High-Net-Worth Individuals

Common 2025 SIP Mistakes to Avoid in the UAE (SCA Investor Protection)

- Keeping Savings in Low-Interest Accounts: Earning 0.5% when markets offer 10%+ (UAE Central Bank Warning)

- Over-concentrating in Home Country: Missing global diversification benefits

- Ignoring Currency Risk: Not hedging AED exposure properly

- Chasing Quick Returns: Falling for get-rich-quick schemes in volatile markets

- Not Using Tax Advantages: Missing UAE’s unique tax-free benefits

Frequently Asked Questions (2025 UAE Edition)

Q: Can I really start with just AED 500?

A: Absolutely! Most UAE platforms allow AED 500 minimum, some even AED 100.

Q: Is my money safe with these platforms?

A: Yes, all regulated by UAE Securities Commission with client asset protection.

Q: As an expat, what happens when I leave UAE?

A: Your investments continue – most platforms allow international access and fund transfers.

Q: Are there Sharia-compliant options?

A: Wallahi, yes! Most platforms offer fully Sharia-compliant portfolios.

More FAQs: UAE Investment Questions Answered

Industry Growth Metrics 2025 UAE

- Digital Investors: 500,000+ UAE residents using investment platforms

- Platform Assets: AED 50+ billion under management

- Expat Participation: 70% of new investors are expatriates

- Youth Engagement: 45% of investors under 35 years old

Your 7-Day UAE Investment Launch Plan

Day 1: Calculate your financial goals using UAE-specific calculators

Day 2: Research and choose your investment platform

Day 3: Gather Emirates ID and UAE bank details

Day 4: Open your account with e-signature

Day 5: Set up first AED 500 automatic investment

Day 6: Schedule bi-annual portfolio reviews

Day 7: Continue financial education through UAE resources

Special Section: UAE Expatriate Investors

For the International Community:

- Invest in your home country markets through UAE platforms

- Consider currency hedging for repatriation planning

- Use UAE’s tax-free status to accelerate wealth building

- Plan for eventual relocation while maintaining investments

Guide for expats: Wealth Building for UAE Expatriates

Final Motivation: Build Your UAE Success Story

As His Highness Sheikh Mohammed bin Rashid Al Maktoum said: “The future belongs to those who can imagine it, design it, and execute it.”

Your AED 500 automatic investment today is that execution. In the fertile ground of the UAE’s thriving economy, with zero taxes, global market access. And innovative platforms, your regular investments can grow into a fortune worthy of this land of opportunity.

The numbers speak clearly – 500,000+ UAE investors are already building their futures through systematic investing. You’re joining a smart community that understands the power of consistent wealth building.

Don’t wait for “someday.” Don’t let analysis paralysis stop you. Your future self, enjoying financial freedom somewhere beautiful, will thank you for starting today.

Start your automatic investment journey. Al yawm! (Today!)

Your Wealth Journey Starts Today

The UAE offers one of the world’s best environments for wealth creation. With zero taxes, robust regulation, and innovative platforms, there’s never been a better time to start your SIP investment journey. Remember – the best time to plant a tree was 20 years ago. The second best time is now.

Ready to begin? Choose one platform, start with AED 500, and watch your wealth grow automatically. Your future self will thank you!

Disclaimer:Investing involves risk, including possible loss of principal. Past performance does not guarantee future results. This content is for educational purposes only and does not constitute investment advice. Consult with a qualified f