Introduction: Join the American Investment Revolution (SIP Investing in the United States)

Hey there, future millionaires! If you’re tired of watching your money gather dust in a savings account while inflation eats away at its value, you’ve come to the right place. Welcome to SIP Investing in the United States – the smart, automated way to build wealth without needing to be a Wall Street expert.

Whether you’re a college student in California, a factory worker in Ohio, a tech professional in Texas, or a retiree in Florida – systematic investing is your ticket to the American Dream. And the best part? You can start with just $50. Let’s dive into your complete 2025 guide.

For our free online earning guide and want to earn then vist 7 Simple Methods to Make $500+ Monthly – No Money Needed to Start (2025 Edition)

What is SIP Investing? The American Way

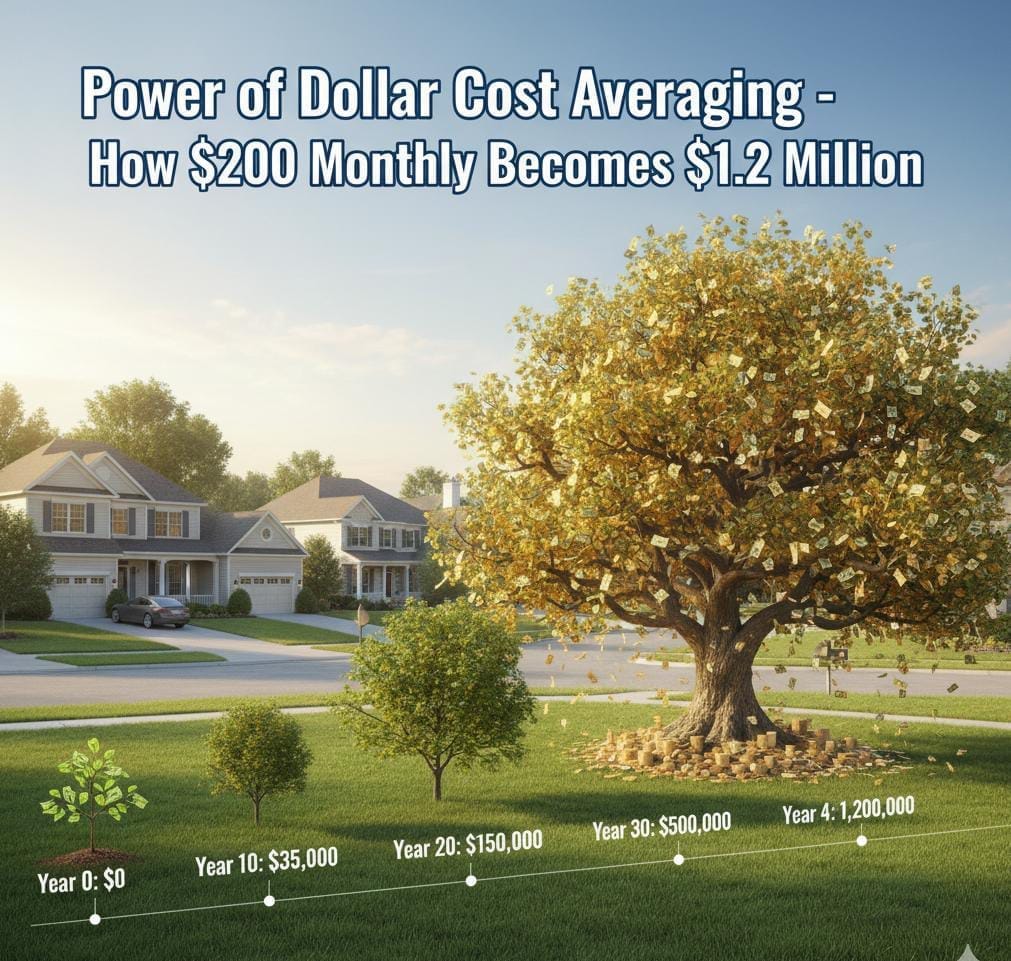

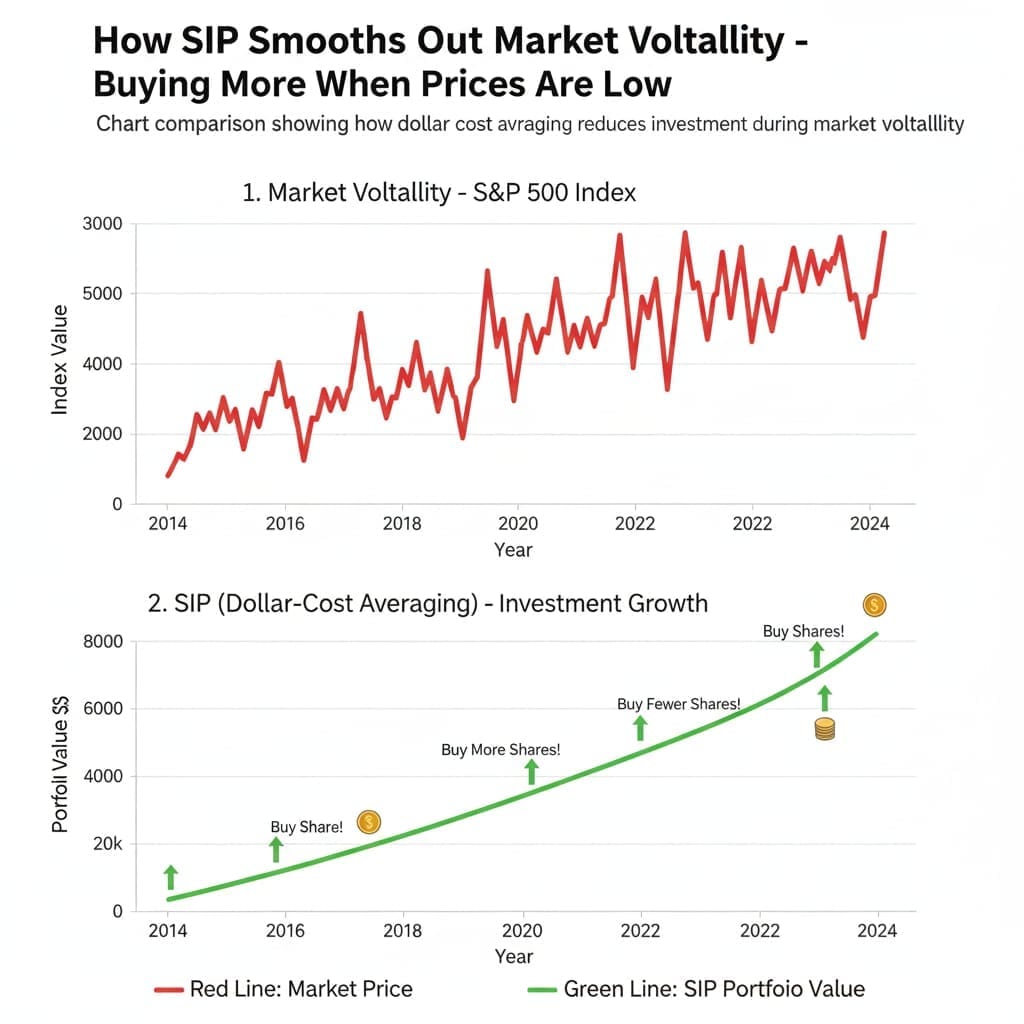

SIP (Systematic Investment Plan) – or what we call “Automatic Investing” or “Dollar Cost Averaging“ – is your set-it-and-forget-it path to wealth building. It’s not a specific product, but a powerful strategy of investing fixed amounts regularly.

Classic American Example: Think of buying gasoline for your car. When prices are low, you fill up your tank. When prices are high, you put in just what you need. Over time, your average cost per gallon balances out. That's Dollar Cost Averaging - the engine that makes SIP work!

Calculate Your Potential: Use the SEC Compound Interest Calculator to see how $200/month can become $1 million in 40 years!

Learn more basics: Understanding ETFs and Index Funds for Americans

Why 2025 is Perfect for SIP Investing in the United State

The Economic Landscape is Promising

- GDP Growth: Projected 2.5-3.5% for 2025 with strong consumer spending

- Inflation Control: Expected to stabilize around 2.5-3% from recent highs

- Market Momentum: S&P 500 showing resilient growth patterns post-recovery

The Digital Investment Boom is Here

- Over 60 million Americans now invest through digital platforms (Investment Company Institute Data)

- Automatic investing features available on every major platform

- Fractional shares make investing accessible to everyone

Current Market Performance: 2025 Real Data

ETF and Index Fund Returns

- S&P 500 Index Funds: ~10-12% (historical average)

- Total Stock Market ETFs: ~9-11% (long-term average)

- Nasdaq 100 ETFs: ~12-15% (tech-focused returns)

- Dividend Growth Funds: ~7-9% (income + growth)

Top Performing Options of SIP investing in the United State

For Beginner Investors:

- Vanguard S&P 500 ETF (VOO): Low-cost market tracking

- Fidelity ZERO Total Market Index (FZROX): Zero expense ratio

- Schwab S&P 500 Index (SWPPX): Low minimum investment

- iShares Core S&P 500 ETF (IVV): Highly liquid ETF option

Official Source: U.S. Securities and Exchange Commission Investor Education

Detailed analysis: Best Index Funds for Americans 2025

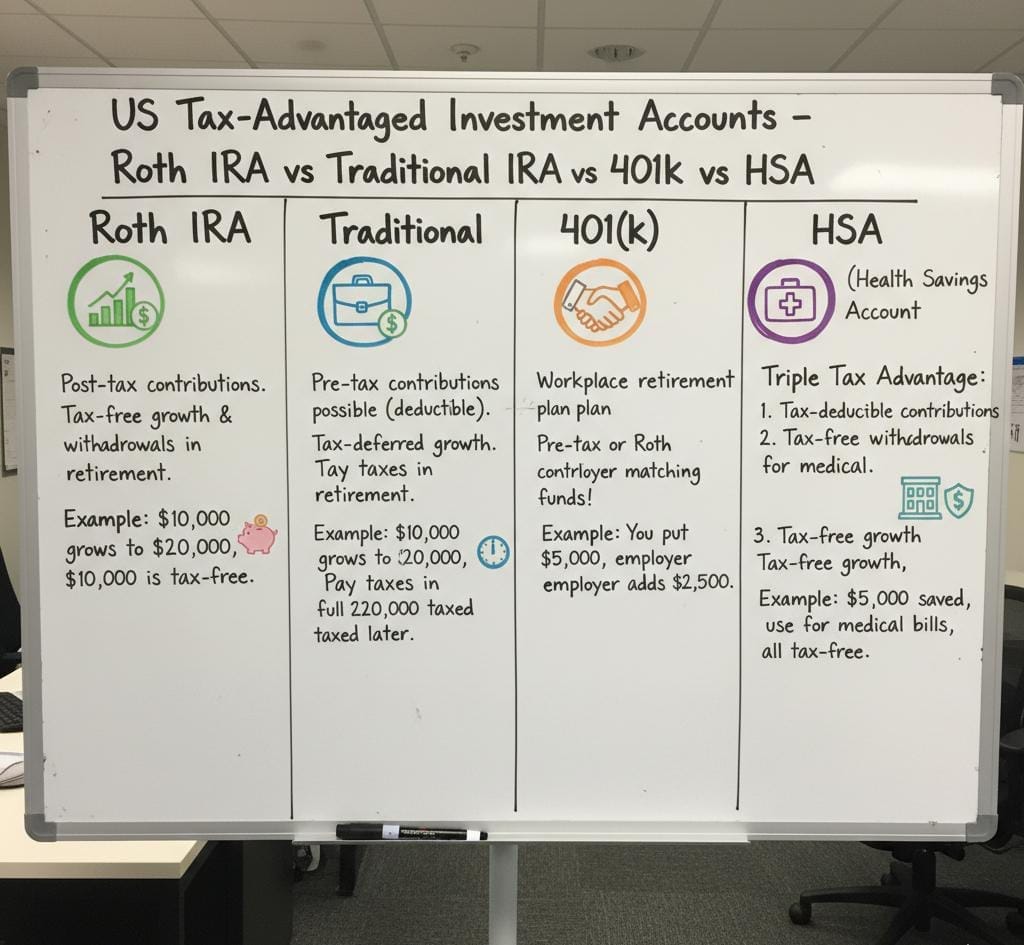

IRS Regulations and Tax Advantages for 2025

Maximize your returns with these tax-advantaged accounts:

- Roth IRA: Tax-free growth and withdrawals in retirement (IRS Roth IRA Guide)

- Traditional IRA: Tax-deductible contributions, tax-deferred growth (IRS Traditional IRA Guide)

- 401(k) Plans: Employer-sponsored with matching contributions (IRS 401(k) Overview)

- HSA Accounts: Triple tax advantage for healthcare investing (IRS HSA Information)

Official Source: IRS Retirement Plans Overview

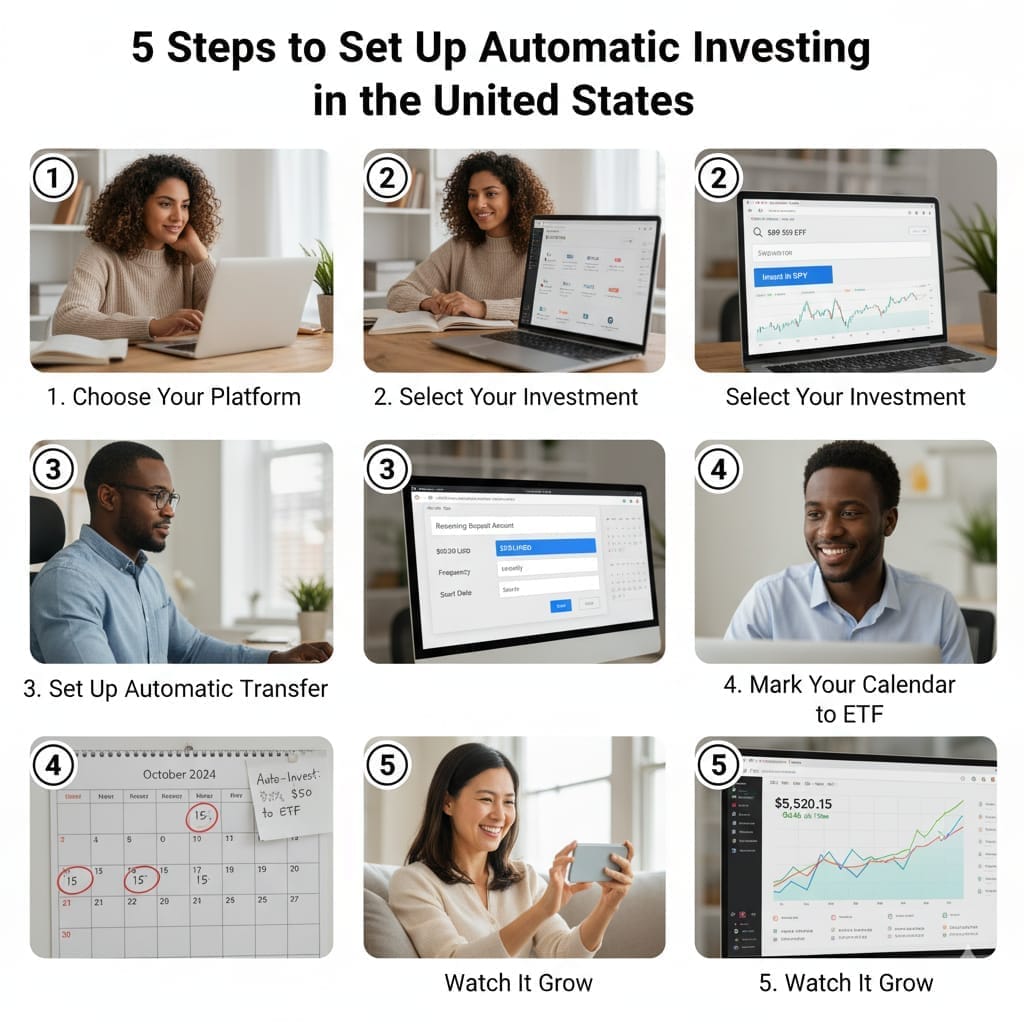

Step-by-Step Starting Guide 2025 ( SIP investing in the united state)

Step 1: Choose Your Investment Account

- Brokerage Account: Regular taxable account

- Retirement Account: IRA or 401(k) for tax advantages

- Education Account: 529 plans for college savings

Step 2: Select Your Platform

Top Recommended Platforms:

- Vanguard: Lowest cost index fund pioneer

- Fidelity: Zero expense ratio funds

- Charles Schwab: Excellent customer service

- E*TRADE: Powerful trading platform

- Robinhood: Commission-free mobile investing

Step 3: Pick Your First Investments (2025 Strategy)

Beginner’s Choice: S&P 500 Index Fund or Total Stock Market ETF

- Instant diversification across 500+ companies

- Professional management built-in

- Historically proven returns with long-term growth

Recommended Starter Investments:

- Vanguard S&P 500 ETF (VOO)

- Fidelity ZERO Total Market Index (FZROX)

- Schwab U.S. Broad Market ETF (SCHB)

Step 4: Set Up Automatic Investments

- Start with $50 (most platforms allow this minimum)

- Choose your investment frequency (weekly, bi-weekly, monthly)

- Enable auto-transfer from your bank account

Step 5: Stay the Course

- Review annually, don’t check daily

- Never stop automatic investments during market drops

- Increase contributions with salary raises

Advanced 2025 Strategies for American Investors

1. The Bump-Up Strategy

Increase your automatic investment by 1% each month. This painless approach can cut years off your wealth-building timeline.

2. Three-Fund Portfolio Approach

Diversify across (Bogleheads Three-Fund Portfolio):

- 50% US Total Stock Market (VTI – Vanguard Total Stock Market ETF)

- 30% International Stock Market (VXUS – Vanguard Total International Stock ETF)

- 20% US Bond Market (BND – Vanguard Total Bond Market ETF)

3. Tax-Efficient Fund Placement

- Stocks in taxable brokerage accounts

- Bonds in tax-deferred retirement accounts

- REITs in Roth IRAs

Advanced strategies: Asset Allocation for American Investors

Common 2025 SIP Mistakes to Avoid in the US (SEC Investor Alerts)

- Market Timing: Trying to guess market movements (FINRA Market Timing Warning)

- Overcomplicating: Too many funds causing confusion

- Fee Ignorance: Not watching expense ratios (SEC Mutual Fund Fees)

- Emotional Trading: Buying high and selling low (Investor.gov Emotional Investing)

- Neglecting Rebalancing: Letting allocation drift (CFA Institute Rebalancing Guide)

Frequently Asked Questions (2025 US Edition)

Q: Can I really start with just $50?

A: Absolutely! Most platforms now allow $50 or even $1 minimums for automatic investing.

Q: Are index fund returns sustainable at 10%?

A: While past performance doesn’t guarantee future results, the US market has averaged 10% annually for nearly a century.

Q: How do I choose between so many platforms?

A: Start with Vanguard or Fidelity for lowest costs, then explore others as you learn.

Q: What if the market crashes right after I start?

A: Perfect! You’ll be buying shares at discount prices through your automatic investments.

More FAQs: American Investment Questions Answered

Industry Growth Metrics 2025 USA

- Automatic Investors: 60+ million Americans (ICI Factbook Data)

- ETF Assets: $15+ trillion industry-wide

- Digital Platform Users: 80% of new investors start online

- Index Fund Adoption: 50% of US household investments

Your 7-Day American Investment Launch Plan

Day 1: Calculate your retirement needs using online calculators

Day 2: Research and choose your investment platform

Day 3: Gather your personal and banking information

Day 4: Open your account and complete verification

Day 5: Set up your first $50 automatic investment

Day 6: Schedule annual review reminders

Day 7: Continue your financial education

Special Section: Young American Investors

For College Students and Young Professionals:

- Start early to maximize compounding

- Consider Roth IRA for tax-free retirement growth

- Take advantage of employer 401(k) matches

- Use apps for micro-investing spare change

Guide for young investors: Investing in Your 20s and 30s

Final Motivation: Build Your American Dream

As the legendary investor Warren Buffett said: “The best time to plant a tree was 20 years ago. The second best time is now.”

Your $50 automatic investment today is that tree. In the fertile soil of the American economy, with its innovative spirit, strong property rights, and dynamic markets, your small regular investments can grow into an oak of financial security.

The data is clear – 60 million+ Americans are taking control of their financial futures through automatic investing. You’re joining a movement that’s transforming personal finance in our nation.

Don’t overthink it. Don’t put it off. Your future millionaire self is waiting to thank you for the decision you make today.

Start your automatic investment plan. Today. Now.

Disclaimer: Investing involves risk, including possible loss of principal. Past performance does not guarantee future results. This content is for educational purposes only and does not constitute investment advice. Consult with a qualified financial advisor before making investment decisions.