2025 Low- Interest Auto Loan: Your Complete Guide to Approval

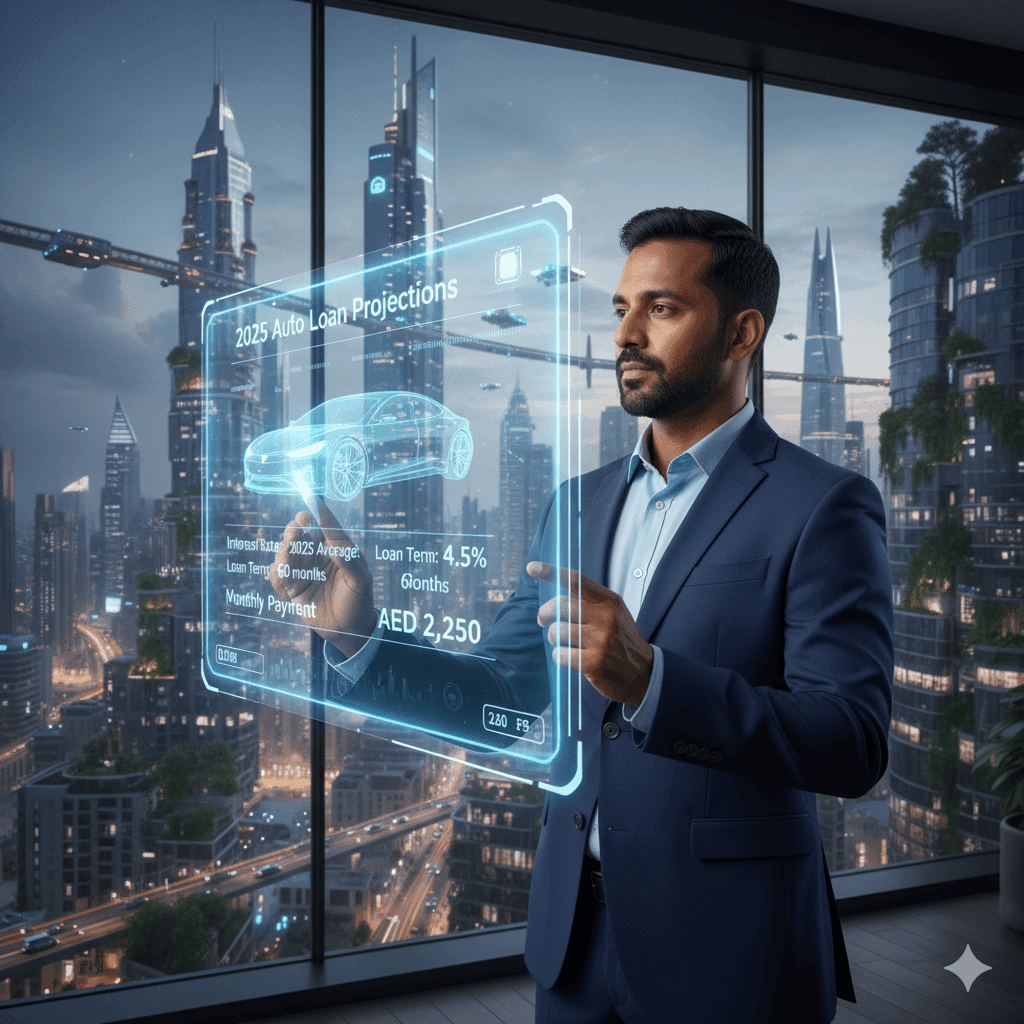

Navigating the auto financing landscape in 2025 requires fresh strategies and updated knowledge. With economic shifts and new lending technologies emerging, securing the ideal 2025 low-interest auto loan demands a proactive approach. Whether you’re eyeing traditional US banks or innovative digital platforms, understanding the current market is crucial for driving away with both your dream car and financial peace of mind.

Pro Tip: Before we dive in, use this free 2025 Car Loan Calculator to see exactly how different rates affect your budget.

Why a 2025 Low-Interest Auto Loan Matters More Than Ever

In today’s economic climate, every percentage point saved on your 2025 low-interest auto loan translates to significant long-term financial benefits. The money you save can be redirected toward building wealth through strategies like those in our guide 7 Simple Methods to Make Money.

2025 Loan Breakdown Example:

- Vehicle Price: $38,000 (reflecting 2025 average)

- Loan Term: 60 months

- Good Credit (2025 low-interest auto loan from Bank of America): 5.2% APR → Total Interest: $5,215

- Average Credit: 8.9% APR → Total Interest: $9,385

That’s over $4,100 in savings that could instead boost your investment portfolio through methods like SIP Investing in the UAE for 2025.

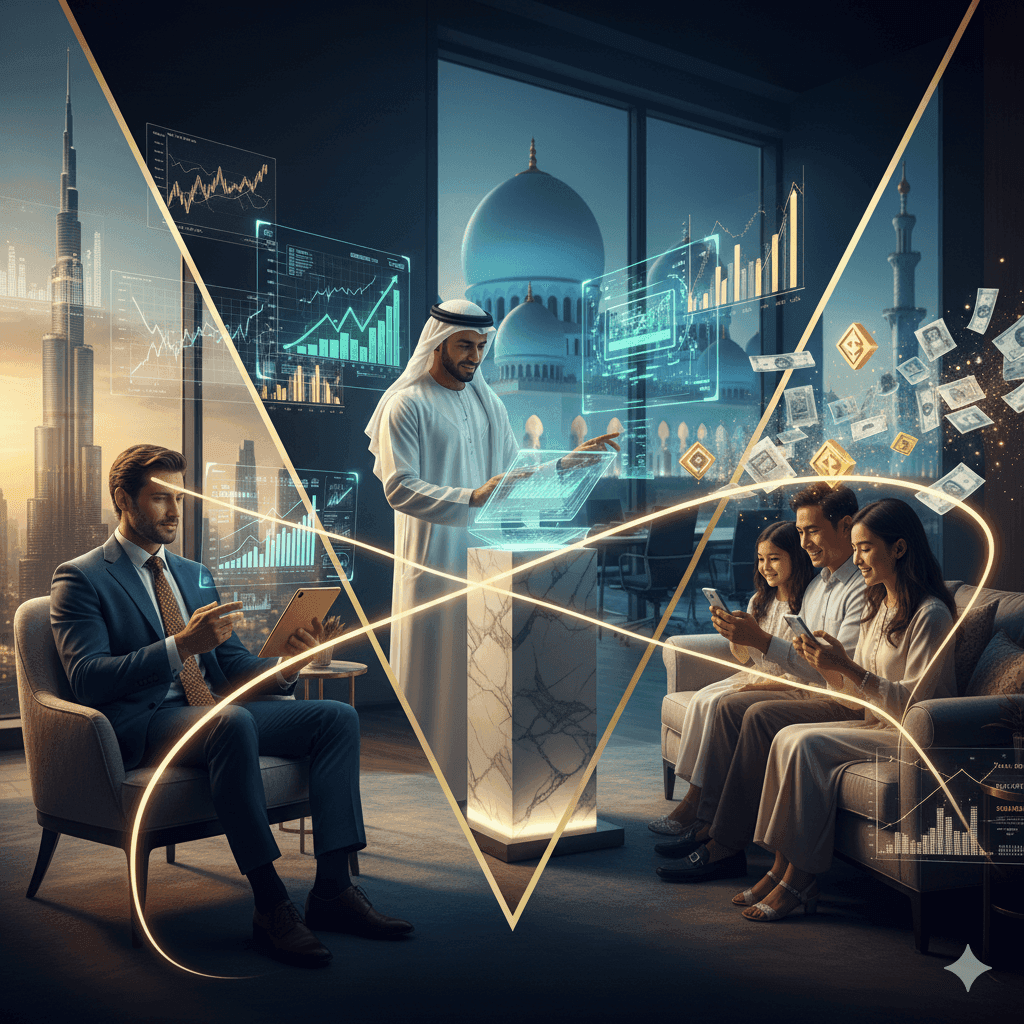

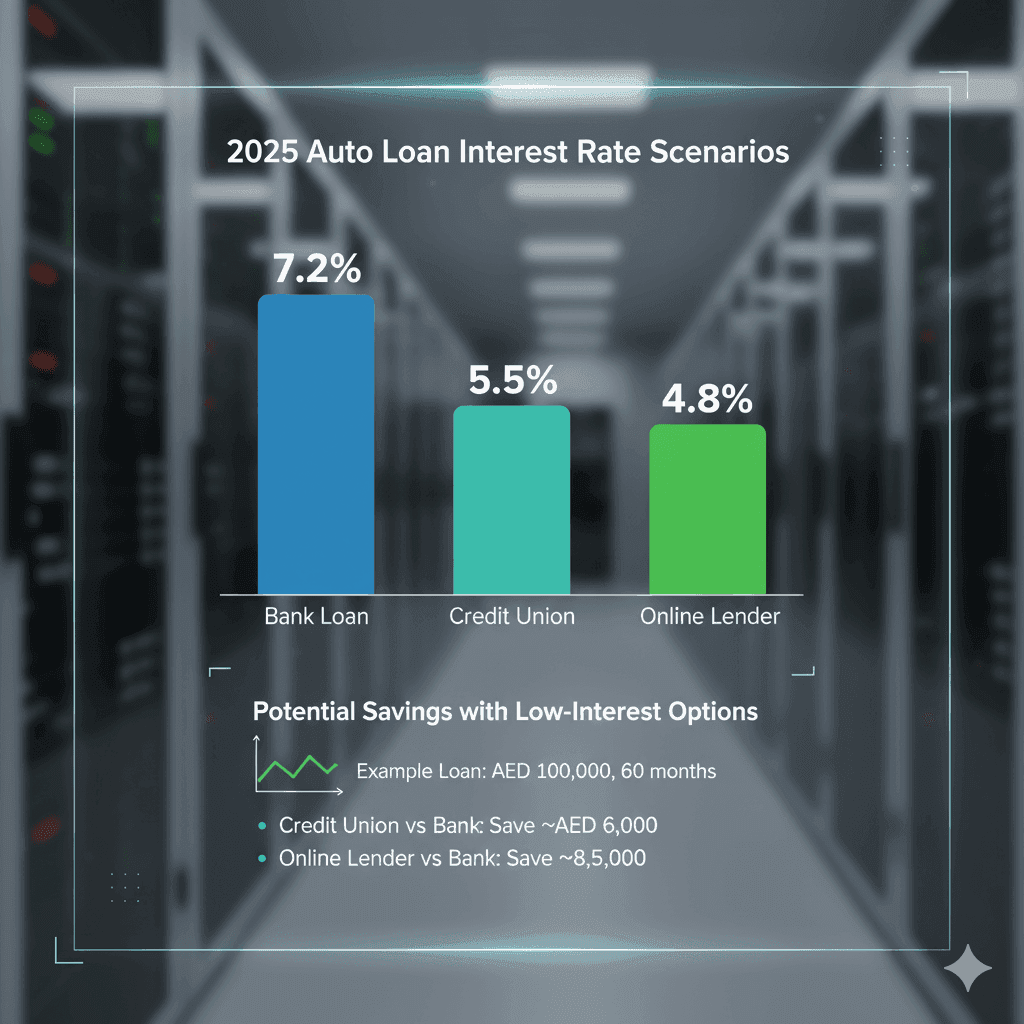

2025 Lender Landscape: Where to Find the Best Rates

1. Credit Unions: Still Leading in Value

Credit unions continue to offer the most competitive 2025 low-interest auto loan options for qualified buyers.

- 2025 Advantage: Enhanced digital services while maintaining member-focused rates

- Verified Rates: Current data from the National Credit Union Administration shows average rates 1.5-2% below major banks

- Top 2025 Picks: Navy Federal Credit Union, Alliant Credit Union, PenFed Credit Union

2. Online Lenders: The Digital Revolution Continues

Digital platforms are dominating the 2025 low-interest auto loan space with AI-driven approvals and competitive pricing.

- 2025 Innovation: Instant pre-approval and real-time rate comparisons

- Current Leaders: LightStream for excellent credit, Ally Auto for competitive market rates

- 2025 Trend: Fully digital loan processing with e-signatures and direct funding

3. Major US Banks: Competitive & Tech-Enhanced

Traditional banks have significantly upgraded their digital platforms to compete for 2025 low-interest auto loan business.

- 2025 Standouts: Chase Auto Loan with their Rate Beat program, Bank of America Auto Loans with preferred customer discounts

- Digital Tools: Enhanced mobile app experiences with instant approval decisions

The Human Element: Financial Confidence in 2025

Securing the right 2025 low-interest auto loan represents more than just a transaction—it’s a step toward financial empowerment. This confidence impacts overall well-being, much like the emotional stability discussed in How to Deal with a Depression Patient. Understanding complex systems, whether financial markets or global politics as analyzed in Trump’s Gaza Peace: A Historical Analysis, remains crucial for informed decision-making.

Your 2025 Action Plan for Loan Success

- Check Your Credit Score (aim for 720+ for best 2025 low-interest auto loan rates)

- Get Multiple Pre-Approvals from different lender types

- Use Current Rate Data from Bankrate and NerdWallet

- Negotiate with Confidence using your pre-approval as leverage

The 2025 low-interest auto loan market rewards prepared buyers. With digital tools and current information, you can secure financing that supports both your immediate needs and long-term financial health.

Ready to drive your future forward? Your 2025 auto loan success starts now.

Disclaimer & Important Notes for Readers

Disclaimer:

The information in this blog post is for general informational purposes. It is also meant for educational purposes only. It is not intended as personalized financial, legal, or professional advice.

- Accuracy of Information: We strive to provide accurate and up-to-date information for 2025. However, auto loan interest rates, lender policies, and market conditions are subject to rapid change. We strongly recommend that you verify all details. Ensure you check current interest rates and terms directly with lenders. This includes banks, credit unions, and online platforms, before making any financial decisions.

- No Guarantees: The mention of specific brands, services, or websites (e.g., Bank of America, Chase, LightStream, NerdWallet) does not constitute an endorsement or guarantee of their services. Loan approvals and final rates are solely at the discretion of the lenders and are based on individual creditworthiness.

- Professional Consultation: We encourage you to consult with a qualified financial advisor. Talk to a loan specialist to discuss your personal financial situation. Obtain advice tailored to your specific needs and goals.

- External Links: This blog contains links to external websites for your convenience. We are not responsible for the content, accuracy, or privacy practices of these external sites.

A Quick Word from Us:

Navigating auto loans can be complex. Our goal is to equip you with the knowledge and tools to feel confident. The financial landscape in 2025 is dynamic, and staying informed is your greatest asset. Use this guide as a starting point for your research. Empower yourself with the linked resources. Always read the fine print. We’re here to provide a helpful roadmap, but you are in the driver’s seat of your financial journey.