SIP Investing in Germany 2025 : Your €50 Weg zur finanziellen Freiheit

Einleitung: Willkommen zur deutschen Investment-Revolution!

Ausgezeichnet! Living in Germany gives you access to Europe’s strongest economy with excellent investment opportunities, but if your money is sitting in a savings account earning minimal interest, you’re missing significant growth potential. With over 12 million Germans now investing in stocks and digital platforms making it accessible to everyone, there’s never been a better time to start your wealth-building journey.

Welcome to SIP Investing in Germany – the systematic, disciplined approach to building your financial future without needing to be a financial expert. Whether you’re an engineer in Stuttgart, a teacher in Cologne, a student in Berlin, or a retiree in Frankfurt – systematic investing through Sparpläne is your path to financial security.

And the best part? You can start with just €50 per month. Los geht’s!

For our international readers, explore our global investment guides.

Was ist SIP Investing? The German Way

SIP (Systematic Investment Plan) – known in Germany as “Sparplan” or “ETF-Sparplan” – is your automated path to wealth creation. It’s not a specific product, but a methodical approach of investing fixed amounts regularly, regardless of market conditions.

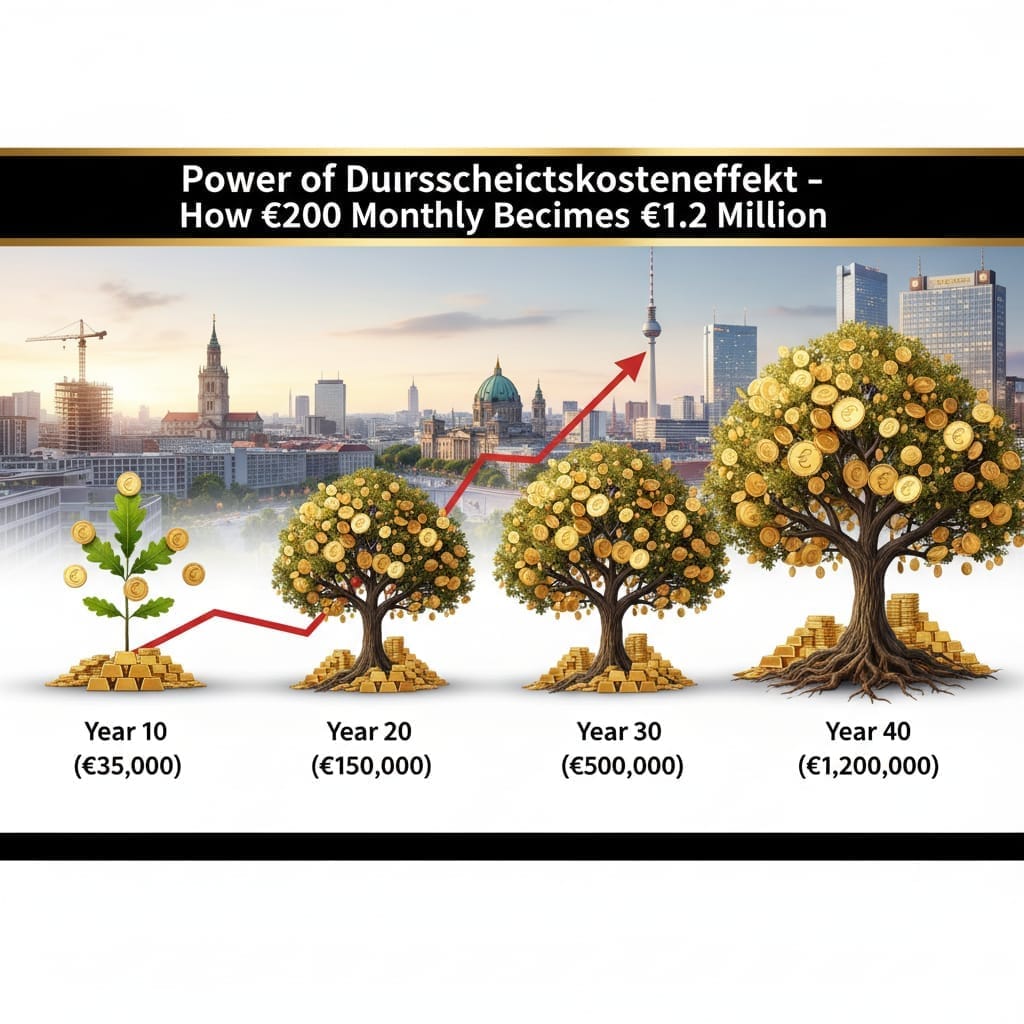

Classic German Example: Think of buying beer at the supermarket. When there’s an Angebot, you stock up. When prices are normal, you buy your usual amount. Over time, your average cost balances out perfectly. That’s Durchschnittskosteneffekt – the efficient approach that makes SIP work!

Calculate Your Potential: Use the Bundesbank Financial Calculator to see how €200/month can become €1 million in 40 years!

For online earning vist our blog based on 7 Simple Methods to Make $500+ Monthly – No Money Needed to Start (2025 Edition)

Why 2025 is Perfect for SIP Investing in Germany

The German Economic Landscape

- GDP Growth: Projected 1.5-2% for 2025 with stable economic fundamentals

- Inflation Control: Expected to stabilize around 2% with ECB management

- Market Strength: DAX showing consistent performance with quality companies

The Digital Investment Revolution

- Over 12 million Germans now invest through digital platforms (Deutsche Bundesbank Survey)

- Auto-investing features available on all major German platforms

- Fractional shares making premium stocks accessible to all investors

Current Market Performance: 2025 Real Data

German and International Fund Returns

- DAX Index ETFs: ~8-10% (historical average with dividends)

- German Equity Funds: ~7-9% (including dividend income)

- Global ETFs: ~9-12% (international diversification)

- European Trackers: ~6-8% (regional exposure)

Top Performing Investment Platforms in Germany

For Beginner Investors:

- Trade Republic: Leading neo-broker with €1 Sparpläne

- Scalable Capital: Popular for free ETF savings plans

- ING DiBa: Traditional bank with modern features

- Comdirect: Comprehensive investment platform

- DKB Broker: Competitive pricing for active traders

Official Source: Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin)

Detailed analysis: Best Investment Platforms in Germany 2025.

German Tax Regulations and Advantages for 2025

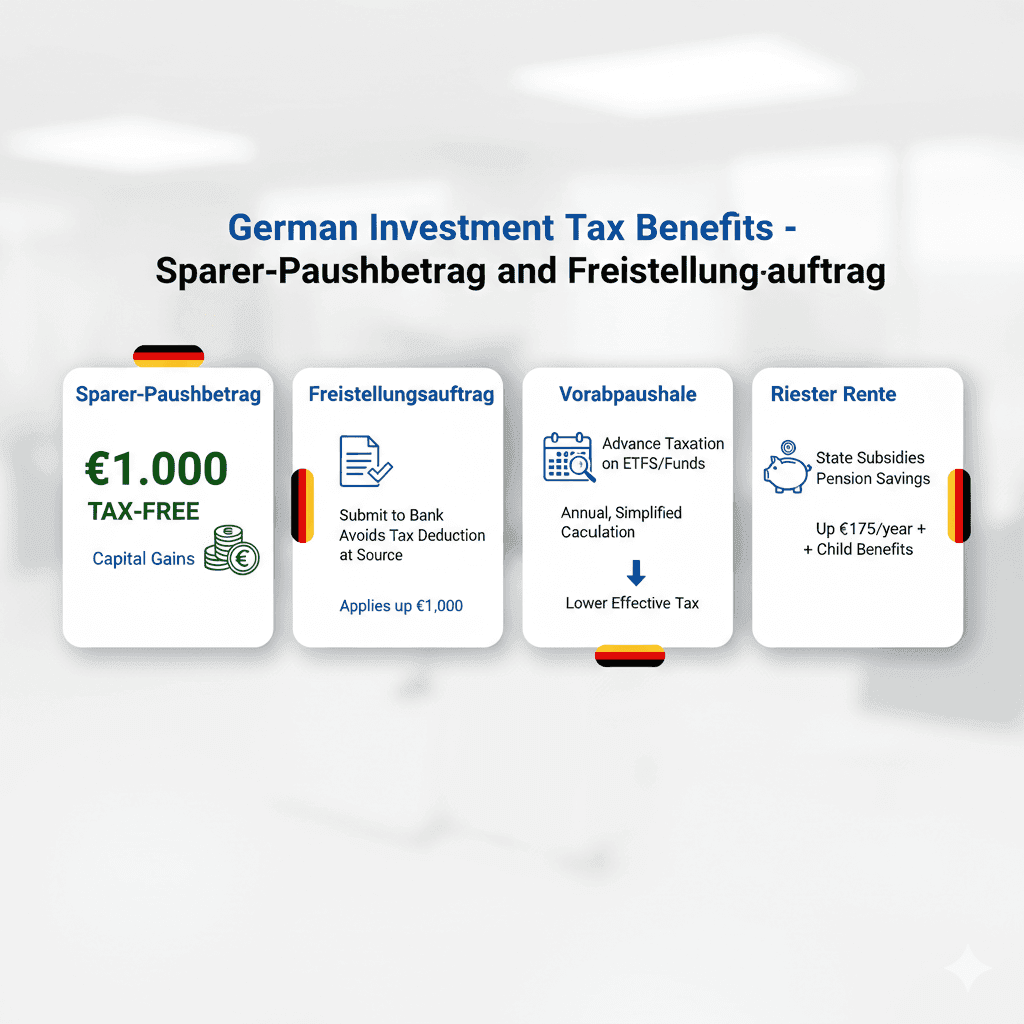

Maximize your returns with these German tax benefits:

- Sparer-Pauschbetrag: €1,000 tax-free investment income annually

- Vorabpauschale: Advance lump-sum taxation for funds

- Freibetrag Order: Tax exemption certificate for your broker

- Riester Rente: Government-subsidized retirement savings

Official Source: Bundesministerium der Finanzen (BMF)

Step-by-Step SIP Starting Guide 2025

Step 1: Choose Your Investment Account Type

- Depot Account: Standard securities account for investments

- Riester Pension: Subsidized retirement savings account

- Private Pension: Additional private pension provisions

Step 2: Select Your Platform

Top Recommended German Platforms:

- Trade Republic: Best for beginners and €1 Sparpläne

- Scalable Capital: Excellent for free ETF savings plans

- ING DiBa: Perfect for traditional banking customers

- Comdirect: Great for comprehensive services

- DKB Broker: Competitive for active traders

Step 3: Pick Your First Investments (2025 Strategy)

Beginner’s Choice: DAX Index ETF or MSCI World ETF

- Instant diversification across German or global markets

- Professional management built into ETF structures

- Proven long-term returns with German market history

Recommended Starter Investments:

Step 4: Set Up Automatic Investments

- Start with €50 (most platforms allow this minimum)

- Choose your investment frequency (monthly recommended)

- Enable SEPA-Lastschrift from your German bank account

Step 5: Stay the Course

- Review quarterly, avoid daily price checking

- Never stop automatic investments during market corrections

- Increase contributions with salary increases

Complete tutorial: How to Set Up Sparpläne on German Platforms.

Advanced 2025 Strategies for German Investors

1. The Gehaltserhöhung Strategy

Increase your automatic investment by the same percentage as your annual salary increase. This maintains lifestyle while accelerating wealth building.

2. Three-Pillar German Portfolio

Diversify across German market sectors:

- 40% German Blue Chips (DAX companies)

- 40% International Equities (MSCI World)

- 20% Bonds and Cash (Capital preservation)

3. Pension Optimization

- Riester Contributions: Maximizing government subsidies and tax benefits

- Betriebliche Altersvorsorge: Company pension plans with tax advantages

- Private Rentenversicherung: Additional private pension insurance

Common 2025 SIP Mistakes to Avoid in Germany (BaFin Investor Warnings)

- Market Timing Attempts: Trying to outsmart markets instead of consistent investing

- Ignoring Fees: Overlooking TER and transaction costs that erode returns

- Overcomplicating Portfolios: Too many funds creating complexity and overlap

- Emotional Decision Making: Buying during euphoria and selling during panic

- Neglecting Tax Efficiency: Not maximizing Sparer-Pauschbetrag and Freistellungsauftrag

Industry Growth Metrics 2025 Germany

- Regular Investors: 12 million+ Germans investing through Sparpläne

- ETF Assets: €400+ billion in German ETFs

- Youth Participation: 48% of new investors under 35

- Digital Platform Growth: 40% annual increase in app-based investing

Your 7-Day German Investment Launch Plan

Day 1: Calculate your goals using Bundesbank financial tools

Day 2: Research and choose your investment platform

Day 3: Gather your Personalausweis and banking information

Day 4: Open your Depot account with video identification

Day 5: Set up first €50 automatic Sparplan

Day 6: Schedule annual portfolio review

Day 7: Continue learning through German financial resources

Special Section: Young German Investors

For Students and Young Professionals:

- Start with neo-brokers for low-cost Sparpläne

- Consider Riester Rente for long-term retirement benefits

- Leverage decades of compounding through early starts

- Balance investing with enjoying your twenties and thirties

Final Motivation: Build Your German Financial Future

As the famous German investor André Kostolany said: “The stock market is the transfer of money from the impatient to the patient.”

Your €50 automatic investment today embodies that patience. In the stable environment of Germany’s financial markets, with strong regulation, quality companies, and excellent tax advantages, your regular investments can grow into substantial wealth.

The statistics are clear – over 12 million Germans are already securing their futures through systematic investing. You’re joining a savvy community that understands starting promptly beats waiting for perfect conditions.

Don’t overanalyse. Don’t postpone until “someday.” Your future self, enjoying financial independence, will appreciate your initiative today.

Start your automatic investment journey. Viel Erfolg!

Disclaimer: Investing involves risk, including possible loss of principal. Past performance does not guarantee future results. This content is for educational purposes only and does not constitute financial advice. Consider your personal circumstances and consult with a qualified financial advisor before making investment decisions. Tax treatment depends on individual circumstances and may change.

- British Woman Shot Dead by Father During Texas Visit: Understanding the Lucy Harrison Case

- Blockchain Technology Trends 2026: Unlock the Decentralized Future

- The Ultimate Costco Food Court Guide 2026: What Just Changed (And What Insiders Order Now)

- Mental Health in Digital Age: The Hidden Crisis Nobody’s Talking About

- How to Get Out of Debt Fast: 7 Proven Strategies That Actually Work

Table of Contents

Lume Chronos

Kann ich wirklich mit nur €50 monatlich beginnen?

Absolut! Most platforms allow €50 minimums, with some accepting even €1 per Sparplan.

Sind diese Plattformen ordnungsgemäß reguliert?

Jawohl! All regulated by BaFin with strong investor protection measures.

Was ist mit Steuern auf meine Investmenterträge?

With proper Freistellungsauftrag, the first €1,000 of investment income is tax-free annually

Sollte ich mich auf Riester oder reguläres Depot konzentrieren?

Beides hat Vorteile. Riester for retirement (subsidies) and Depot for flexibility and earlier goals

Leave a Reply