Why Nepal Gold Prices Are Dropping: A Complete Market Analysis

The glitter of Nepal Gold Prices has recently been overshadowed by a significant price drop, leaving investors, jewelers, and soon-to-be-buyers wondering what’s happening. After a sustained period of high prices, this sudden decline has created a buzz in the market.

If you’re asking whether this is the right time to buy, sell, or wait, you’ve come to the right place. This blog breaks down the reasons behind the drop, analyzes the current situation, and provides a clear outlook for the future of gold prices in Nepal.

The Current State: A Look at Today’s Nepal Gold Price

The immediate cause of the price change in Nepal is always linked to the international market. Recently, global gold prices have faced downward pressure, and this has directly impacted local rates.

Major jewelry hubs in Kathmandu, like Ason and Indrachowk, have adjusted their prices accordingly. The price of fine gold (24K) per tola has decreased significantly from its previous highs. For the most accurate and up-to-date live rate, always check our dedicated Daily Gold Price Update page.

This volatility creates uncertainty for everyone, from traders managing their inventory to families planning purchases for upcoming festivals like Teej.

Key Reasons Behind the Falling Gold Prices in Nepal

The drop in gold prices isn’t random; it’s driven by a combination of global and local factors. Here are the primary reasons:

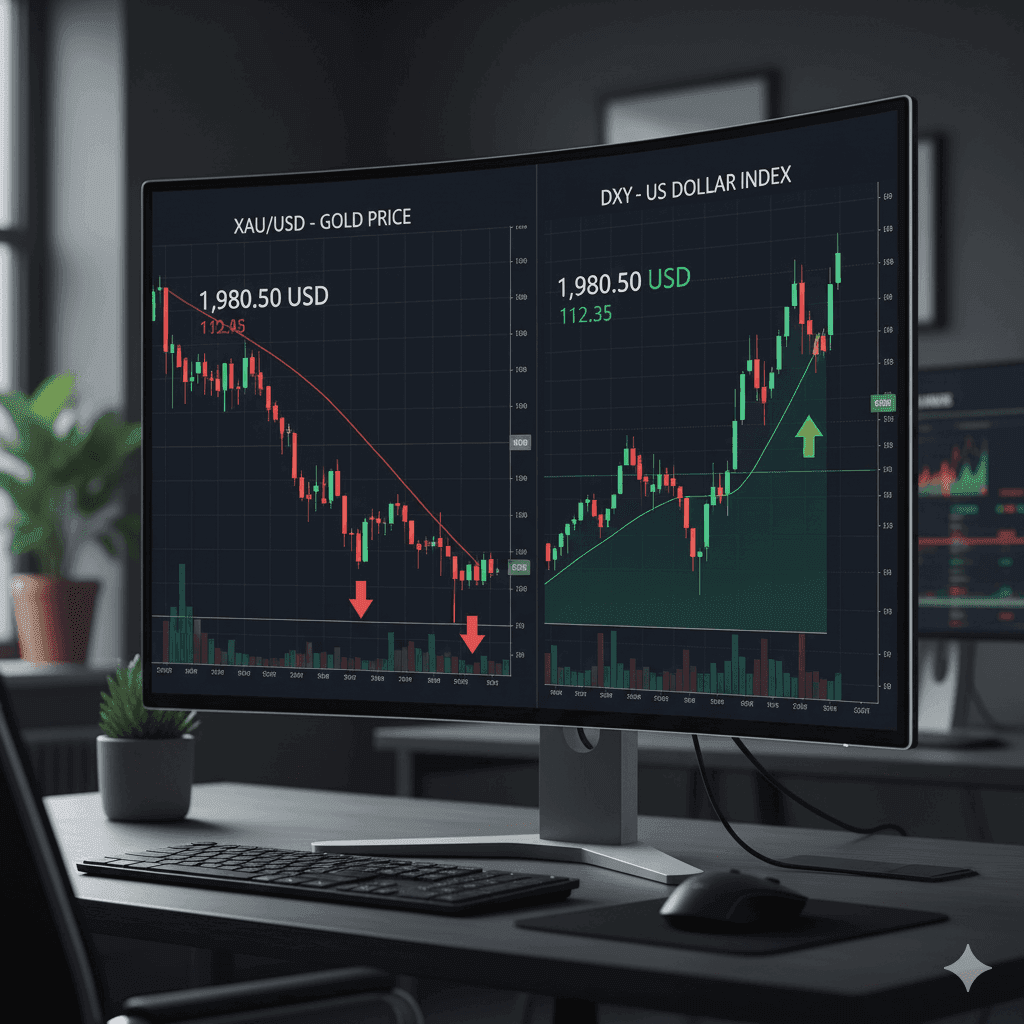

- A Strengthening US Dollar: Gold is globally priced in US dollars. There is a strong inverse relationship between the two—when the dollar gets stronger, gold becomes more expensive for holders of other currencies, which typically reduces demand and pushes its price down. Recent strength in the USD is a major factor in gold’s decline [“Gold Dips as Robust Dollar, Yields Dent Appeal].

- Shifting Global Economic Sentiment: When economic data suggests stability or potential interest rate hikes by central banks like the Federal Reserve, investors may move their money from non-yielding assets like gold to interest-bearing assets (e.g., bonds). This shift in investment strategy reduces the demand for gold.

- Profit Booking by Investors: After a long bull run, many investors who bought gold at lower prices see a price drop as a trigger to “book profits” and sell their holdings. This wave of selling further accelerates the price decline.

- The Nepal Rastra Bank’s Influence: The exchange rate set by the Nepal Rastra Bank for the US dollar against the Nepali Rupee also plays a crucial role. A stable or slightly adjusted rate can influence the final landed cost of gold in the domestic market.

Should You Buy, Sell, or Hold? A Practical Guide

This is the most pressing question for anyone connected to the gold market. The answer depends entirely on your goals:

- If you are buying for a wedding or festival (like Teej): A price drop is excellent news. It allows you to purchase more for your money. This could be an opportune moment to make your purchase. For guidance on what to look for, read our article on Essential Tips for Buying Gold During Teej.

- If you are a long-term investor: Market corrections are normal. Historically, gold has always been a safe-haven asset over the long term. A dip can be a good entry point for strategic, long-held investments, but be prepared for further short-term volatility.

- If you are considering selling: If you bought gold at a much lower price and need liquidity, you can still realize a good profit. However, if you sell during a panic-driven dip, you might miss out on potential price recoveries later. Avoid panic selling.

Future Outlook: What’s Next for Gold in Nepal?

Predicting the exact movement of any commodity is impossible. However, the fundamental drivers of gold remain strong. It is still considered a safe-haven asset during times of geopolitical uncertainty and inflation.

While prices may continue to be volatile in the short term due to the factors mentioned above, the long-term outlook for gold as a store of value remains intact. The upcoming festive season in Nepal could also see a surge in demand, potentially providing support to local prices.

For finance vist Home

Final Thoughts

The recent drop in Nepal’s gold prices is a complex event driven by international finance and local market dynamics. For buyers, it’s a window of opportunity. For investors, it’s a reminder of market volatility. For everyone, the best strategy is to stay informed, understand your own financial goals, and avoid making impulsive decisions based on short-term market movements.

Keep following our market analyses for the latest insights and data-driven guidance.

Table of Contents

yup

yes why not

thank you

yes what can we do for you

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me…